Student debt is one of the most important things to consider when you’re thinking about going to college. College is extremely expensive, whether you end up graduating or not; you have to pay for the years of college you attended even if you end up dropping out. This can make it more difficult to pay off the student debt. Here’s what you need to know about paying off student debt, especially if you didn’t graduate.

Student debt is one of the most important things to consider when you’re thinking about going to college. College is extremely expensive, whether you end up graduating or not; you have to pay for the years of college you attended even if you end up dropping out. This can make it more difficult to pay off the student debt. Here’s what you need to know about paying off student debt, especially if you didn’t graduate.

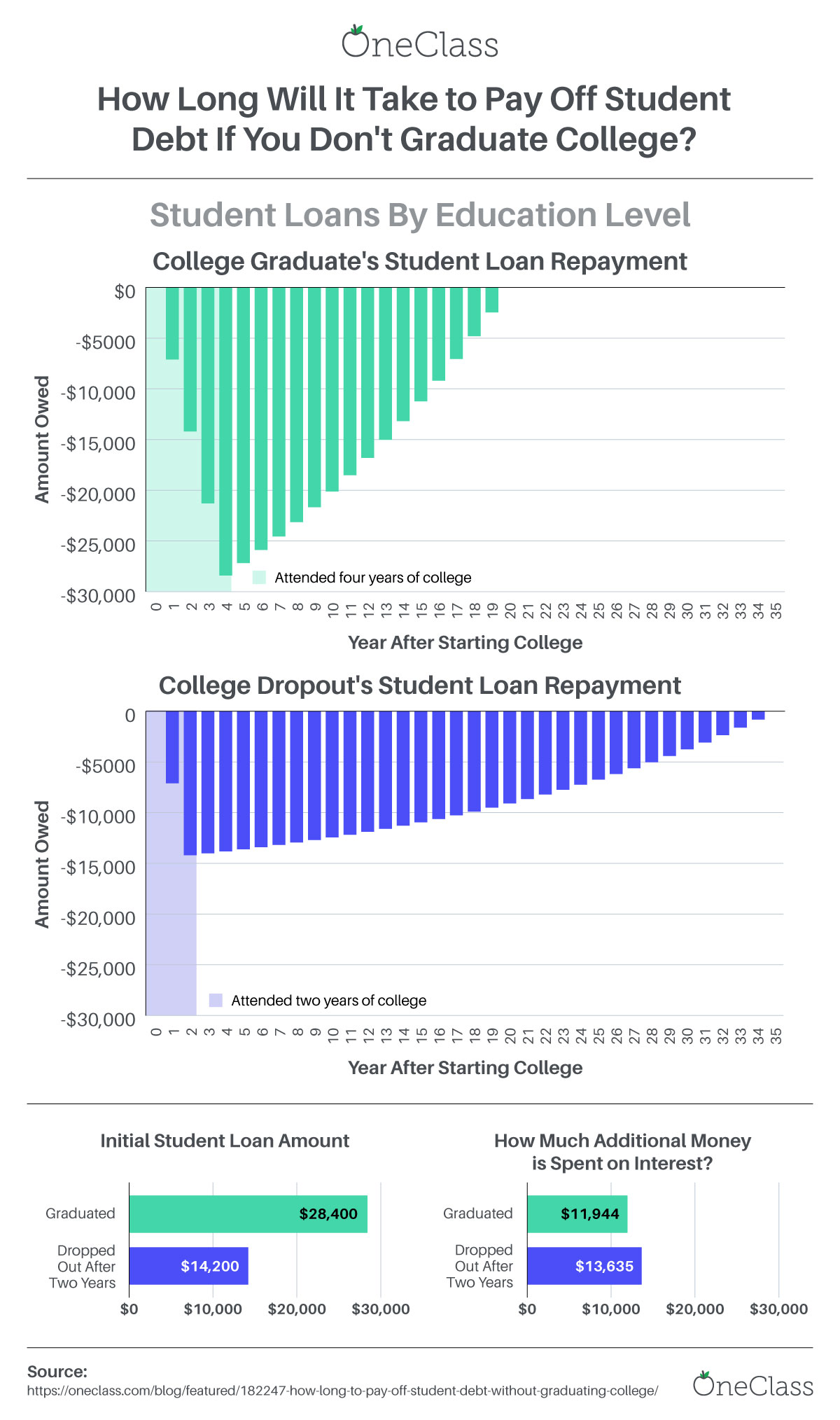

How Long Will It Take to Pay Off Student Debt If You Don’t Graduate College? Created By: OneClass

The Amount of Debt

The specific amount of debt is an important part of understanding how long it might take you to pay off your student debt. Obviously, if you finish college, you’ll have more debt; on average, college ends up creating around $7,100 in student debt per year. This means someone who only attends college for one or two years will have less actual debt than someone who completes college.

Yearly Income

One of the benefits of completing college is that completing college increases your yearly income on average. According to the U.S. Bureau of Labor Statistics, someone who has completed “some college” without completing any degrees makes $41,704 on average. On the other hand, someone with a four-year bachelor’s degree makes $62,296 on average. This is a 49% increase with a college degree, meaning that once you’re done with college, you’re likely to make more money.

Minimum Payment Options

Minimum payments are possibly the most impactful part of the reason why it may take someone with less college education more time to pay off their loans. Because someone with a bachelor’s degree makes more money than someone who never graduated, they can often afford to make higher minimum payments. This means they’ll pay off the actual loan more quickly, spending less money on the interest. In fact, because of the lower minimum payments, someone who never graduated may actually pay more interest on their loan than someone who did.

Interest Rates

Being able to find great interest rates is an important part of reducing the amount of interest you end up paying. If you initially took out two years of student loans at an interest rate of 4.66% and you’re able to refinance them to 3.66%, you can pay $3,355 less over the years. A degree can make it easier for you to find a refinancing option, but even people without a degree may be able to find great refinancing for their loans.

How to Avoid Student Debt Problems After College

How can you reduce student debt problems once you’re done with college? You can join people in calling for reduced or eliminated debt for students, especially students who attend certain state colleges. This can reduce your financial burden for graduation. It’s also a good idea to find study programs either online or in your area that can help you study more easily. This can help you get through college more easily.

Conclusion

For most people, it will actually take longer to pay off student debt if you don’t graduate, even if you end up with less debt. With a degree, it takes 19 years on average, but if you only do two years of school, it takes 34 years on average. Finishing your degree can help set you up for a better career after you graduate, so make sure you take all the necessary steps to improve your grades and handle school more easily.